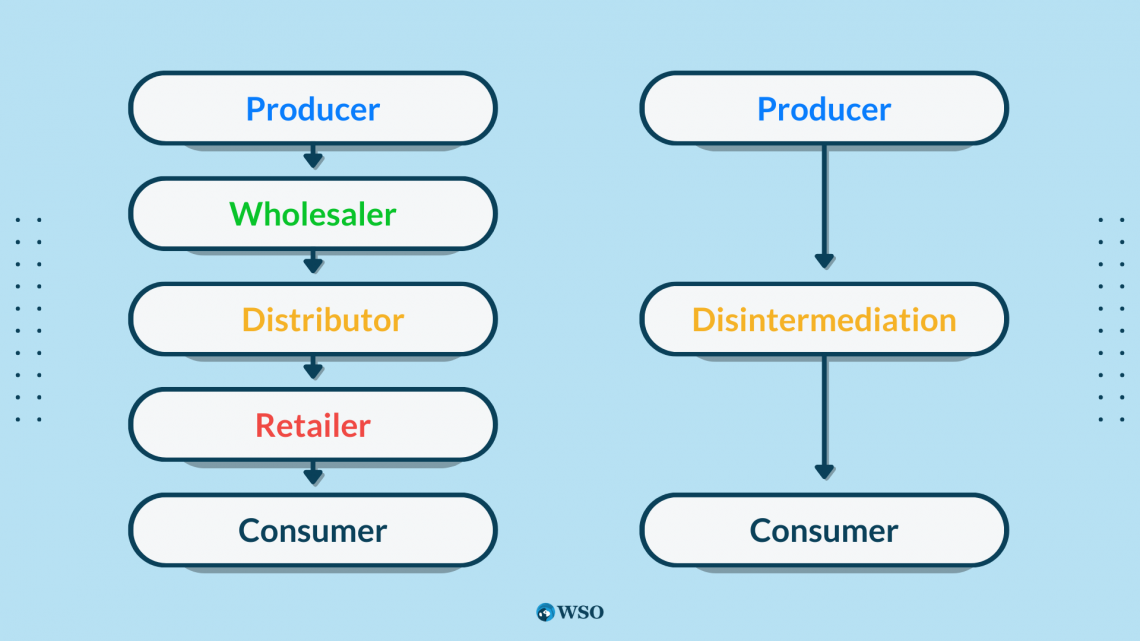

It involves eliminating intermediaries within an economic supply chain.

Rani Thakur is an Economics Honours student at Delhi Technological University, skilled in finance, economics, research, and analytics. She has interned as a Financial Research Analyst, Business Growth Intern, and Financial Accounting Intern.

Reviewed By: Matthew Retzloff

Matthew started his finance career working as an investment banking analyst for Falcon Capital Partners, a healthcare IT boutique, before moving on to work for Raymond James Financial, Inc in their specialty finance coverage group in Atlanta. Matthew then started in a role in corporate development at Babcock & Wilcox before moving to a corporate development associate role with Caesars Entertainment Corporation where he currently is. Matthew provides support to Caesars' M&A processes including evaluating inbound teasers/ CIMs to identify possible acquisition targets, due diligence, constructing financial models, corporate valuation, and interacting with potential acquisition targets.

Matthew has a Bachelor of Science in Accounting and Business Administration and a Bachelor of Arts in German from University of North Carolina.

Last Updated: February 28, 2024 In This ArticleDisintermediation involves eliminating intermediaries within an economic supply chain, essentially bypassing the traditional "middlemen" during transactions or a series of transactions.

Rather than following conventional distribution channels that typically include intermediaries like distributors, wholesalers, brokers, or agents, businesses now have the option to engage directly with customers, often through online platforms such as the Internet.

This allows consumers to make direct purchases from wholesalers, skipping retailers or enables businesses to place orders directly with manufacturers without involving distributors. In the financial sector , it occurs when investors can acquire stocks without the intermediary role of brokers or financial institutions.

The primary objectives behind this process typically include cost reduction, expedited delivery, or a combination of both.

The term "disintermediation" originated in the 1960s to characterize a decline in funds held by conventional financial intermediaries and investment tools, replaced by a preference for direct investment in markets, presenting the opportunity for increased returns.

Over time, the term has been applied in diverse scenarios, encompassing the development of novel information channels and business frameworks that sidestep established intermediaries.

In the field of real estate, property transactions commonly rely on intermediaries like agents, brokers, and legal representatives.

These middlemen connect purchasers and vendors, ensuring adherence to legal requirements and streamlining the process of transactions.

In a scenario where real estate transactions incorporate blockchain technology, individuals engaged in buying and selling can interact directly on the blockchain using smart contracts.

The smart contract triggers the fulfillment of the agreement when predefined conditions are satisfied, diminishing the need for conventional intermediaries such as agents and brokers.

The real estate transaction process is streamlined by this decentralized method, increasing its efficiency and possibly lowering expenses for all parties.

Disintermediation can happen when a buyer interested in purchasing goods can directly buy them from the producer. This direct approach can lead to lower prices for the buyer since it cuts out intermediaries like traditional retail stores.

In opting for this approach, the purchaser sidesteps additional expenses linked to the price increase that transpires as a commodity transitions from a distributor to a seller prior to reaching the consumer.

The process of disintermediation was initiated with the implementation of interest rate restrictions on savings accounts by the U.S. government in 1967.

The regulatory adjustment, perhaps unintentionally, has created opportunities for other financial institutions. These institutions can now appeal to savers by offering more favorable interest rates on alternative investment avenues, including certificates of deposit and money market accounts.

The banking sector's experience set the stage for a broader phenomenon that would later extend its influence to diverse industries.

Independent channels for consumers gained traction with the rise of technological progress , facilitating easier access to information on investment options and the autonomous execution of transactions.

The hotel and travel industries saw considerable transformations in the mid-2000s. Hotels started booking directly with customers on platforms like Expedia and Priceline, reducing the need for travel agents.

The dynamics of the newspaper sector evolved as more readers gravitated towards online news outlets. This shift led to a decreased reliance on conventional newsstands and publishers, marking a significant disintermediation in the industry.

The newspaper industry saw a transformation as more readers opted for online news sources. This change decreased the reliance on traditional newsstands and publishers, exemplifying a significant disintermediation process in the sector.

The Following includes how the internet helps in disintermediation:

The following includes some of the examples of disintermediation.

In the 1990s, Dell held a notable edge over rivals like Compaq and IBM, primarily due to their embrace of a direct sales approach.

Dell achieved incredible growth by implementing a direct-to-consumer sales strategy, bypassing middle management, and providing customized services. This increased the company’s revenue from $60 million in 1994 to $25 billion in 1999.

Tesla employs a unique sales model by bypassing traditional dealerships and opting for their outlets to feature a limited number of vehicles for display and test drives.

Customers finalize their entire purchase process through online channels. This distinctive approach contributed to a 34% increase in Tesla's auto gross profit.

Additionally, it enables Tesla to exert greater control over the customer experience and foster an online community. Inspired by Tesla's achievements, both Audi and General Motors initiated experiments with direct sales in 2012 and 2013, following a similar path.

At a fixed cost, property owners can independently list their homes on the MLS, removing the requirement for a full-service real estate agent.

Rather than entrusting the entire selling process to a conventional agent, sellers prefer a flat fee arrangement to showcase their property on the MLS. This database is commonly used by real estate professionals to exchange information about properties for sale.

This provides sellers with an opportunity to enhance the visibility of their listings, all the while preserving a higher degree of influence over the selling process.

Property sellers have the potential to lower expenses associated with commission costs, as they are not mandated to allocate a percentage of the sale price to a conventional real estate agent.

Nevertheless, vendors might find themselves responsible for managing different facets of the transaction on their own, such as promoting the product, engaging in negotiations, and handling documentation.

Apple utilizes a strategy of directly reaching consumers, promoting and vending its products via online platforms and brick-and-mortar retail outlets. This approach enables the company to circumvent conventional retail pathways, granting the chance to establish premium pricing for its products.

The following includes the benefits of disintermediation:

Disintermediation, while offering advantages such as enhanced profit margins and reduced transit time for companies, comes with its recognized risks. These potential drawbacks encompass:

Reintermediation involves reintroducing an intermediary between producers and end users (consumers), especially in situations where disintermediation was previously observed.

Disintermediation has revolutionized the consumer landscape, enabling direct online purchases from producers and sidelining traditional supply chain middlemen.

Interestingly, instead of a straightforward, producer-to-consumer connection, the scene has evolved to include digital intermediaries like Amazon.com and eBay, injecting a fresh dynamic into the equation.

The shift towards reintermediation was prompted by various challenges associated with the direct-to-consumer model in e-commerce.

Issues such as the high cost of shipping numerous small orders, extensive customer service demands, and potential conflicts with disintermediated retailers and supply partners posed significant obstacles.

The absence of supply chain middlemen, who previously served as sales representatives for producers, meant that producers had to assume the responsibility of acquiring customers themselves.

Selling products online also incurred additional expenses, including website development, product information maintenance, and marketing costs. Moreover, limiting product availability to online channels required producers to compete for customer attention in an increasingly crowded digital space.