Florida provides statutory lien waiver forms. While parties can agree to use an alternate form, no party can be forced to use a form that differs from the statutory form.

![]()

Florida statutory lien waivers are not required to be notarized, and gain no practical benefit from notarization.

![]()

Florida specifically prohibits waiving lien rights in a contract prior to furnishing labor and/or materials, to the project.

![]()

While lien rights may not be waived prior to furnishing labor or materials. However, waivers ARE allowed prior to payment.

Lien waivers are pretty complex documents. But they are also unassuming because of how frequently they get exchanged on construction jobs across the country, and in Florida. A lien waiver is basically a receipt that payment has been made for work or materials on a job. These documents are exchanged at the time of payment, and commonly attached to subcontractor pay applications or vendor invoices.

There are different types of lien releases for different types of situations. And these documents have significant consequences for everyone on a job — as it connects directly to everyone’s right to cash! Also, one pesky aspect of lien waivers is that the process of sending, requesting, tracking, and collecting lien waivers is an administrative pain that slows down the payment on a project.

Knowing everything you can about lien waivers will allow you to make your process faster. And if your process is faster, your cash will move faster; and that’s good news for everyone on the project!

Florida lien waivers (commonly called Lien Waiver and Releases in Florida) are regulated by state statute, and the specific rules and form requirements can be found under Fla. Stat. §713.20. Florida’s approach to lien waivers is pretty unique, and because there are some tricky things about whether certain things are or are not required, it can lead to some confusion regarding your Florida mechanics lien rights. Here are two things that are particularly unique to Florida’s mechanics lien waiver laws.

Generally speaking, a Florida lien waiver form must contain specific language and information. Yet, these are recommended forms, not necessarily required. The statutory forms are offered as a safe, mistake-free option for parties to use. However, if the parties agree beforehand to use an alternative lien waiver form, the waiver is still enforceable according to the terms of the waiver.

This allows parties to be able to agree to their own terms concerning lien waivers. The only exception to this is that contractors and suppliers cannot be required to use a non-statutory form. There must be mutual consent to use the alternate form. If using an alternate form, be wary of the inclusion of language that waives more contract and mechanics lien rights than originally anticipated. And be wary about the extent of the other party’s “consent.”

As written, the lien waiver forms provided by the Florida statutes are unconditional, meaning valid and enforceable upon signing. If using one of these forms and payment hasn’t already been made (i.e. deposited in your account), then you may want to execute a conditional waiver form. Florida law specifically allows claimants to add language which conditions the enforceability of the waiver upon payment. Which is always the safer bet.

While all this may seem like an aggravation on first blush, the truth is that not having lien waiver rules is the real headache.

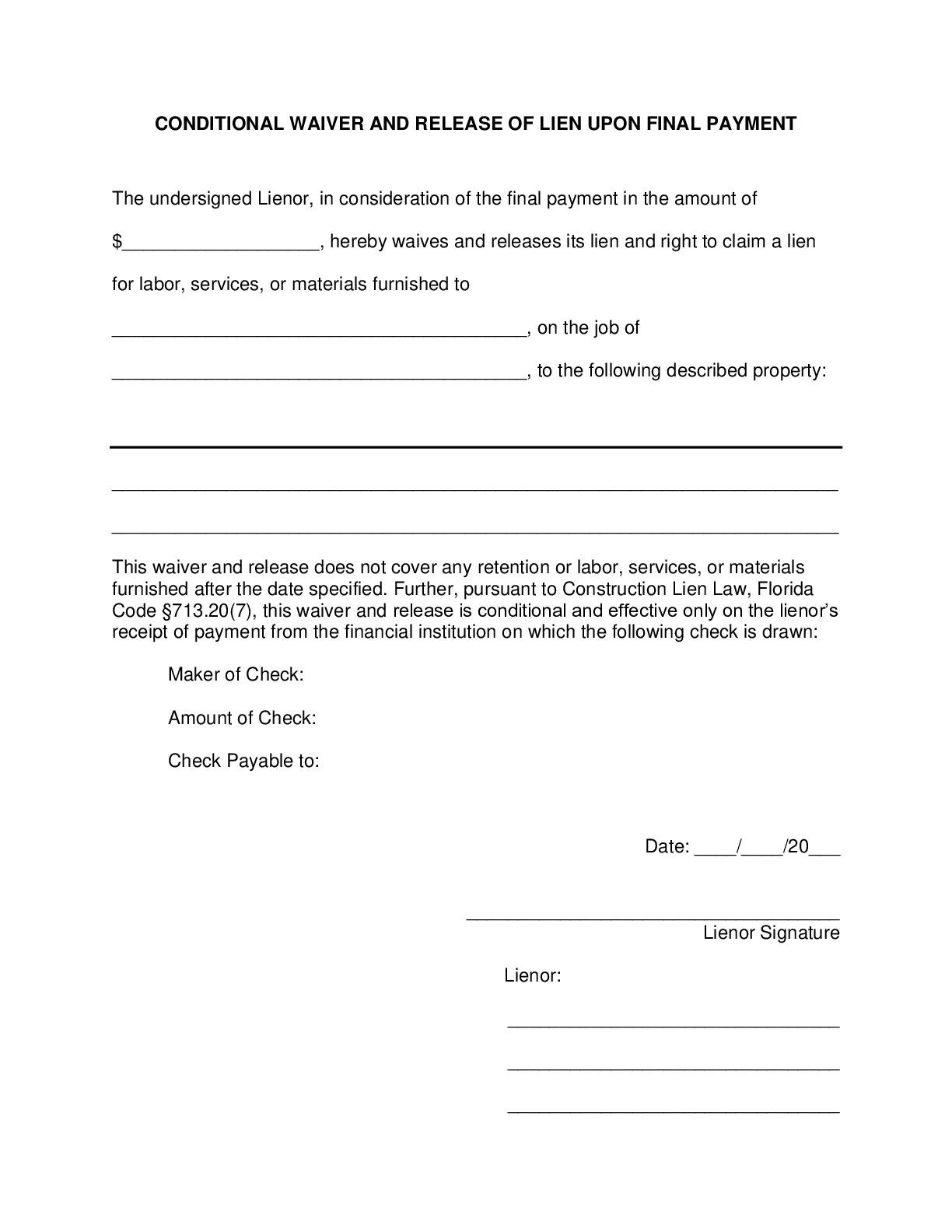

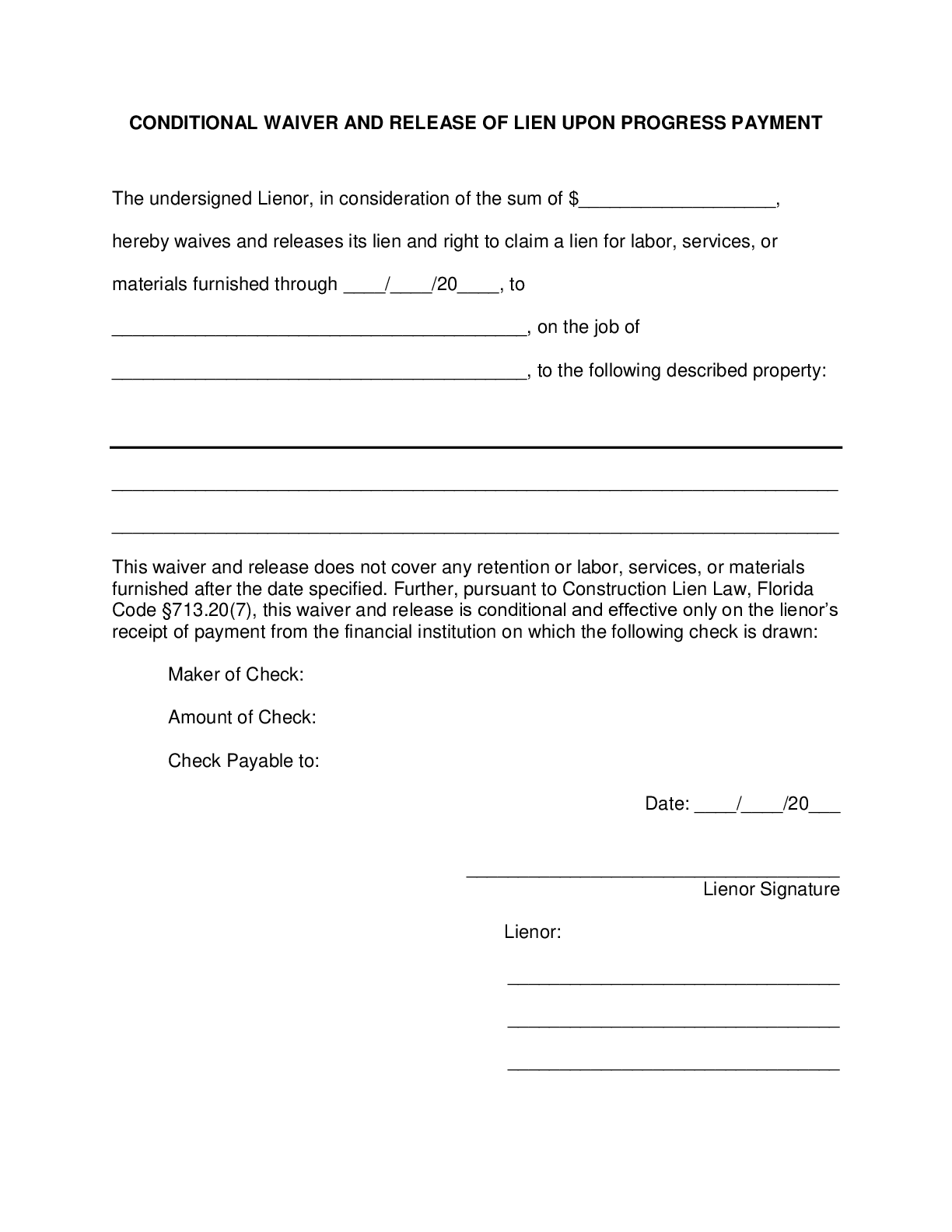

If you’re having trouble filling out these Florida statutory lien waiver forms, here are two guides to help you find the proper form, input the correct information, and convert them to conditional waivers if need be:

Whether using the statutory forms or an alternate lien waiver form, mistakes can still be made. This is why it’s so important to understand Florida’s lien waiver requirements. This page contains lots of information, FAQs, guides, forms, and more, to help you become a master of the complex Florida lien waiver requirements.

Florida has specific lien waiver forms that can be used by everyone on an Florida construction project. Using these forms is safe, easy, stress-free, and fair for everyone involved. Under some circumstances, parties can agree to use other lien waiver forms in Florida.

The forms provided here for free by Levelset are compliant with the Florida statutes. You can download them free, or use our free system to send or request your compliant Florida lien waiver form.

These Florida lien waiver forms are compliant with the state's requirements. Make it easy, and use forms from the source you can trust.

This Conditional Waiver and Release of Lien Upon Final Payment is for use on construction projects in Florida. Signing this waiver signifies that the final.

This Conditional Waiver and Release of Lien Upon Progress Payment is for use on construction projects in Florida. Signing this waiver signifies that the partial.

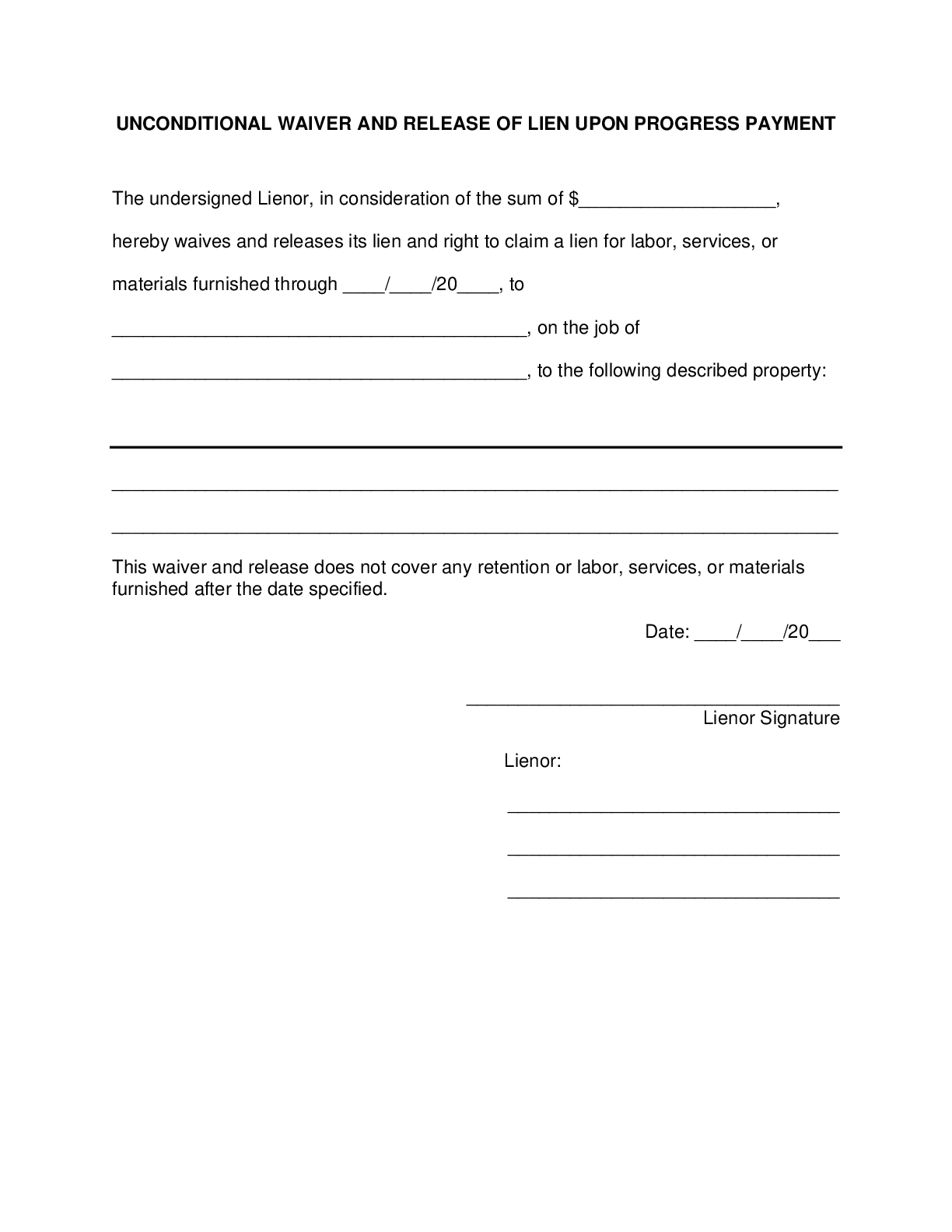

This Unconditional Waiver and Release of Lien Upon Progress Payment is for use on construction projects in Florida. Signing this waiver signifies that the partial.

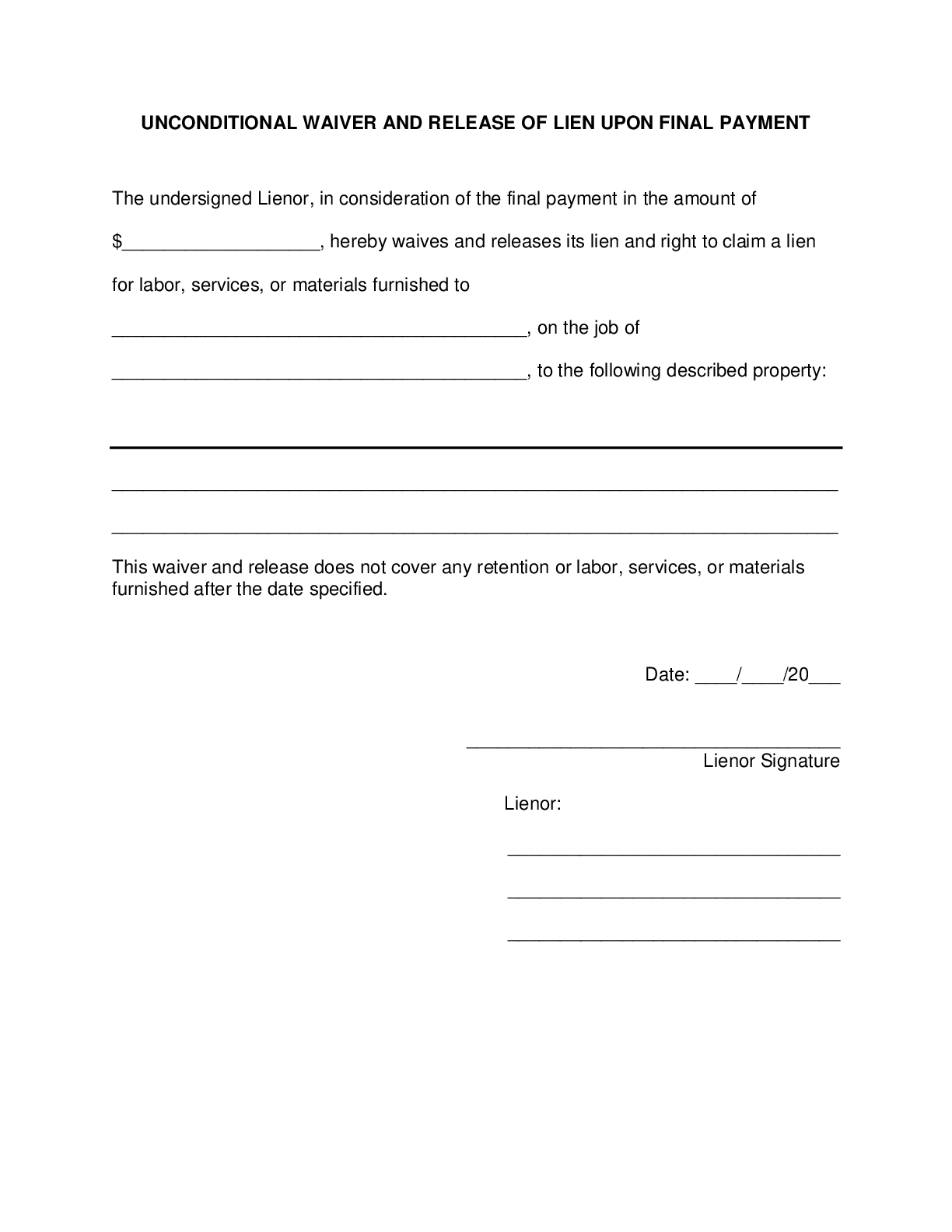

This Unconditional Waiver and Release of Lien Upon Final Payment is for use on construction projects in Florida. Signing this waiver signifies that no further.

Florida's lien waiver requirements and rules under Florida Statutes §713.20 can be difficult to understand, especially since some of the rules are more like suggestions. This can create some murky situations. We have some of the most common questions about Florida's lien waiver rules below, answered by Florida construction attorneys to help you get paid what you've earned.

Sort of…Well, maybe.

Florida is one of the 12 states that provide statutory lien waiver forms. So, within Florida’s legal rules, there are actual form templates provided for lien waivers. And, the laws state that a form “may” be used that is “substantially similar” to the provided templates.

However, the statutes also provide an exit from the required template if the parties agree to something else. “A lien waiver or release that is not substantially similar to the forms…, is enforceable according to the terms of the lien waiver or release.” Therefore, if both parties agree to an alternative waiver form, they can do so. But keep an eye out for language that may waive more than just lien rights.

Under Florida statute, a person may not require a lien waiver that is different from the statutory forms provided. For an alternate form to be valid, both parties must agree to the alternate lien waiver form ahead of time. This is explicitly mentioned under Fla. Stat. § 713.20(6), “A person may not require a [contractor] to furnish a lien waiver or release…different from the forms” provided.”

There is a practical difficulty with this. If someone is waiting on payment and the owner, lender, or general contractor refuses to make a payment without signing a specific lien waiver form, there will be a lot of pressure to just sign. However, if the contractor or supplier stands firm, they will have a really terrific position, because this is explicitly made illegal by the Florida law.

So, parties can agree to use an alternative form, but cannot be forced to. And therefore, if you dabble in a different form, there is a question of whether the other form is “forced” or if it’s “agreed to.” That’s a sticky argument that parties will want to avoid.

We talked about it in more detail when discussing one of the biggest Florida lien waiver mistakes: Getting Mixed Up About Which Form To Use.

The statutory forms as provided by statute, are unconditional lien waivers. Meaning that once the waiver is signed, it effectively waives lien rights; regardless if payment has been made or not.

However, under Fla. Stat. §713.20(7), “A lienor who executes a lien waiver and release in exchange for a check may condition the wavier and release on payment of the check.” Therefore, the statutory forms can be converted into a conditional lien waiver simply by adding conditional language to the waiver form. We recommend the following language:

Pursuant to Fla. §713.20(7), this waiver and release is conditional and effective only on the lienor’s receipt of payment from the financial institution on which the following check is drawn:

If using the standard, unconditional statutory lien waiver forms, then they will be binding upon the execution (i.e. signing) of the form. If the “conditional language” has been provided, then the waiver will only become valid and binding once the referenced check/payment has cleared.

As for any non-statutory forms, the same general rules apply, but they will be enforceable in accordance with the terms of the waiver itself.

No, Florida statute specifically prohibits contract provisions that waive lien rights before work is performed. We refer to these as “ no-lien clauses, ” and many states, including Florida, have prohibited this practice. This prohibition applies to waivers contained in the contract, and any purported waiver prior to performance of work.

Even though a contractor or supplier cannot waive their lien rights in a contract — regardless of what they sign — it’s really common for contracts to include language suggesting exactly this. And it’s common for people to not know any better.

In fact, there was recently a crazy situation in Orlando related to this. The contractor wasn’t being paid and got really, really frustrated. Instead of filing a Florida mechanics lien, the contractor “sabotaged the project” by crippling the project’s elevators! The contractor got in big trouble for this, and was splashed all over the media. The contractor claimed he needed to sabotage the project because “under the contract signed with the owner, he was not allowed to file a lien.”

The problem is, even if such a contractual provision existed, it would have been invalid! If only the contractor read this page first…

Florida specifically prohibits waivers before work begins (see the previous question & answer), but after work begins, the parties can execute a valid lien waiver before payment is actually made.

This is why it’s so important to add “conditional language” to the lien waiver is payment hasn’t been received yet. If a contractor or supplier signs an “unconditional lien waiver” before they have cash in the bank…they could get stuck without lien rights; regardless of payment.

However, if using an alternate lien waiver form, and the terms state that the document needs to be notarized, then it will be required. Alternate lien waiver forms are enforced according to their terms. Unfortunately many owners and general contractors still feel it necessary to require notarization of waivers, even though it is a burdensome, and unnecessary practice if not required by state law.

If using one of the Florida statutory lien waivers, the following information must be included:

That depends. The statutory progress payment waivers include a section that states, “ this waiver does not cover and retention or labor, services, or materials furnished after the date specified .” So, future lien rights are still reserved when submitting progress payment waivers.

The final payment form provided doesn’t contain language reserving any lien rights. As far as best practices are concerned, it’s generally a good idea to add an exceptions section if there is pending retention or unapproved change order payments.

Does the word "Upon" turn the Florida unconditional lien waiver into a conditional lien waiver? UNCONDITIONAL WAIVER AND RELEASE OF LIEN UPON PROGRESS PAYMENT (Pursuant.

We are a Crime Scene Trauma Scene company; we provided services on a home in Port St. Lucie, Florida. The clean-up was completed and per.

We are a subcontractor and are owed just under $1,400,000 from the General Contractor we did Hurrican Ian work in Florida. The work ended in.

Need to file a Florida mechanics lien? File your mechanics lien with Levelset, the lien experts quickly and easily. Or you can follow the 3 steps below to file a lien yourself with Levelset's free information.